Are you interested in Financial Independence (FI) or even FIRE (Financial Independence Retire Early) but are confused about how you can figure out how much money you really need in order to make that dream a reality? In this post I will take you though the most commonly used FI formula, some limitations you should be aware of as well as a few adjustments you might want to make based on your specific situation to help ensure a successful result. After all it isn’t really Financial Independence if you run out of savings before your run out of retirement.

Traditional formula for FI

First we will start with the formula you have likely seen if you have spent any time researching how to calculate your FI or FIRE number.

FI = Annual Expenses * 25

or another way you will see this written is:

FI = (Annual Expenses / 0.04)

Both of these formulas yield the same result. I think you tend to see the first formula more frequently simply because it is easier for most people to calculate.

Where did this formula come from?

This formula came from data reported in the Trinity Study. This study looked at the performance of retirement accounts with different asset allocations and different withdrawal rates to determine which had the highest likelihood of lasting through retirement.

One of the most reported outcomes of this study was a 4% “safe withdrawal rate” (SWR). Essentially, they found by limiting withdrawals to 4% (adjusted for inflation) you would have a 96% chance of success (i.e. not running out of retirement savings). I don’t know about you, but a 4% chance of failure doesn’t sound particularly reassuring or safe to me.

What are the limitations of the Trinity Study?

There are a few limitations you should be aware of when considering the 4% guidance as a “safe withdrawal rate.” This is especially true, if you are more risk adverse and want to have a reliably “safe” withdrawal rate when calculating your FI number. First, the study only included data through 1995. Second, the withdrawal duration was limited to 30 years. This duration is too short for many of us who are working towards FIRE (Financial Independence Retire Early) or a FIRE-like goal. Third, the SWR is heavily influenced by your portfolio allocation. I haven’t seen this point emphasized enough out there in the FI/FIRE discussions.

Improving the FI formula

So what would help to improve the FI formula? First, it would be helpful if the data period could be updated to include more recent years. Another helpful tweak would be to extend the duration beyond the 30 years included in the original study. A duration of 50 years would give a lot more confidence in the results. Finally, being able to see the worst case scenario for different asset allocations and withdrawal rates would help provide additional insight for balancing risk with potential rewards. Fortunately for all of us, Baptiste Wicht over at The Poor Swiss has done the heaving lifting/analysis for us and provides the results in his post Updated Trinity Study for 2022 – More Withdrawal Rates which I highly recommend reading in it’s entirety.

Updated Results

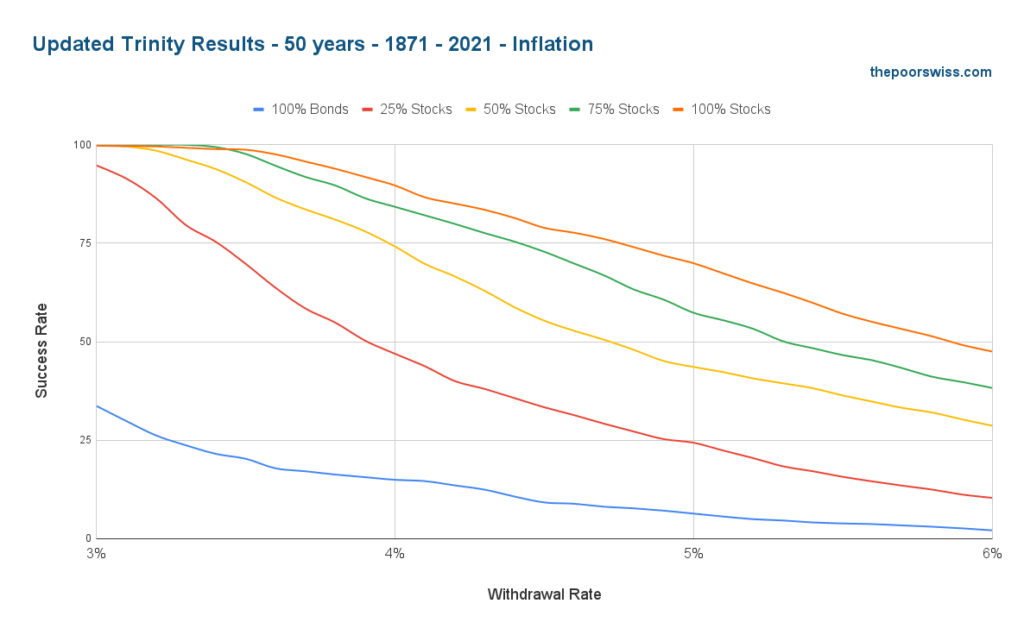

In the chart below you can see that extending the duration out to 50 years impacts the safe withdrawal rate pretty substantially:

Based on these results, 4% doesn’t seem very safe for any of the asset allocations he reviewed. Less than 75% success with a 50/50 allocation? Yikes! However, if you reduce your withdrawal rate modestly down to 3%-3.5% you significantly increase your likelihood of a successful result.

“A 100% allocation to stocks and a 3.5% withdrawal rate still have more than a 98% success rate. This is significantly more than I expected.”

Baptiste Wicht – thepoorswiss.com

Recall that the original study had a 96% success rate at 4%. So this means that even after extending the duration from 30 years to 50 years you can still increase your success rate through a modest reduction in your withdrawal rate from 4% to 3.5%.

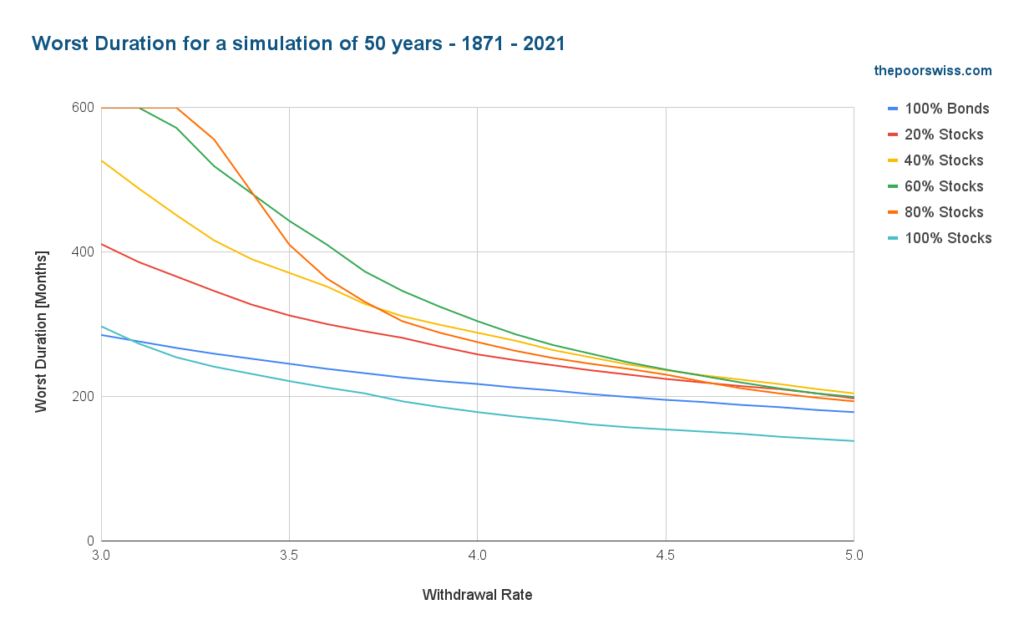

Another important scenario Baptiste laid out was the worst duration where he measured how many months until the first failure can happen.

Here you can clearly see that even though a 100% stock allocation will give you the highest success rate, you also have the highest risk in really (really) bad market performance. Bonds are critical in helping to buffer your portfolio if (when) stocks fall off a cliff.

The 80% stocks/ 20% bonds allocation seems to be the best balance of risk to reward, at least for me. You will need to review these charts and determine what makes the most sense for you given your specific situation and risk tolerance.

Safe(r) FI Calculation:

Based on these updated results, you can modify the FI calculation as follows:

FI = Annual Expenses / Withdrawal Rate

So what does this mean in dollars… for me, the standard formula would yield:

$1,875,000 = 75,000 / 0.04

While using the safer formula would yield:

$2,142,857 = 75,000 / 0.035

This is an increase of almost $500k versus the standard formula which is a significant increase. While I am not thrilled to learn this, it definitely helps in planning next steps. If you find yourself in a similar position you have the following choices:

- Delay retirement completely

- Have a phased-in retirement where I work part-time for a certain number of years to shorten duration and decrease needed withdrawals

- Reduce retirement expenses

- Increase retirement contributions to hit new target on the original timeline

- Stick to your original plan, cross your fingers and hope for great portfolio performance ( this is the only choice I would not recommend)

You may decide that doing a combination of some of these would work best for you and that is okay. On the way to FI it is important to remain flexible and to adapt to changing conditions.

Wrapping it all up

While the traditional FI formula of 25 x annual expenses or 4% of expected annual expenses is a great place to start when trying to determine your target for Financial Independence there is a lot of risk in stopping there. Based on updated data, you may find that a lower withdrawal rate would be a safer bet for you, especially if your retirement duration is longer than 30 years. It can also help you to evaluate your current plan and make adjustments now that will help you get to your goal.

I hope you have found this information to be helpful. I know that I personally learned a ton researching this topic for this post.